Evästeet

EvästeetLinkki avautuu uudessa välilehdessä

EvästeetLinkki avautuu uudessa välilehdessä

Climate change tools defined by the Church Pension Fund are used, where possible, in all asset classes. The Pension Fund primarily uses investment funds in its investment activities, and so the evaluation and selection of investee companies is carried out by external asset managers. It is therefore the responsibility of the investment unit of the Pension Fund to select successful, responsibly functioning funds and asset managers as their partners and to cooperate with them to achieve the objectives of the climate change strategy and to develop related activities. The Pension Fund favours funds and asset managers who have set carbon neutrality targets for their own investment activities.

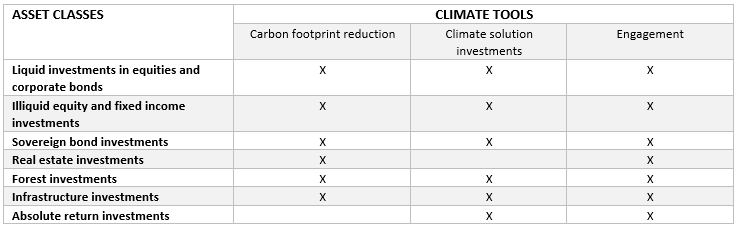

Summary of the use of the Pension Fund's climate tools in different asset classes:

This entry indicates that the tool is used for the asset class concerned. The use and shape of tools vary by investment.